Before we start, let’s take a moment to realize:

how crazy the internet is;

how kind and generous Deli is.

It’s an honor to have an absolute legend of our industry on this Substack. In this interview, Deli went in-depth into some critical topics such as adapting to the ever-evolving markets, bouncing after tough times and what his day to day life looks like.

Please show him some love and share this on Twitter and in your Discords. Thank you.

<START>

Q) Anthony, I don’t think we need to introduce you to our readers today. With more than 25 years in the trading industry, from being one of the youngest members in CME Group history to now trading behind screens, it’s fair to say that you’ve been at the front seat of the evolution of our beautiful industry. You lived through more ups and downs than most will ever experience. You achieved every goal that less experienced traders can dream of. From low lows to high highs, what is motivating you to keep going at it with so much energy in 2024?

My passion for trading. It has been a huge part of my life and has given me the opportunity to live the life I wanted. At this stage of my career, it's about legacy for me. It's about truly helping the retail trader last longer and be more profitable than the stats suggest. I came from a time when help from traders was free and readily accessible, and I used it almost daily.

In today’s trading world, it's lonely, and there are many fraudsters out there. My goal is to provide free content to help traders like many helped me. Teach them how to think, not what to think. Give them hope and motivation that they can succeed in this business.

Q) Your slogan is “Develop your edge”. Your pinned tweet is amazing, and I relate a lot to it. I myself lost for 10 years before finding profitability. How much time did it take you to develop your edge?

I'm still developing my edge. Every edge I have found in this business has worked for a period of time and then it stopped working. It's why I live by the following phrase: everything works sometimes, nothing works all the time.

Because I truly believe in that, when I'm struggling, I can recognize if it's one of three things: is it me? Is it the market environment? Is it my strategy? If I am honest with myself and how I'm following my strategy and executing it, then I can constantly work on improving my edge in one of those three categories. If it's me, I know to work on myself. If it's the market environment, I study that environment and learn how to trade it better when we get in a similar environment in the future. If it's my strategy, then I look to see what I can do to improve that.

Q) Inexperienced traders discover the market through their screens. You didn’t.

I read this paragraph online:

If you would have to start again today from zero, would you prefer to do it in the modern area or like in the 90s (and why)?

I would choose the 90s because I can see how markets actually work before I trade. It was instrumental in my success to understand how markets work. There are brokers, independent traders, spreaders, hedgers, and for every single person in those pits and on the phones calling orders in, they all had their own strategies and no two traders were exactly the same. My ideas for my strategy stemmed from watching how other traders executed and found what resonated with me and built my own strategy.

In today's world, people are much more followers than doers. They want answers but don't have questions. More want to be told what to do, not learn what to do. We need time to learn this business, and when it's in person, you are forced to take the time to learn the grassroots of this business.

Q) You run a website, a Discord, and a YouTube channel where you share a lot of information. You are very transparent and generous with your content, and especially about your strategy. You use the Bollinger band on a daily chart combined with a Fibonacci retracement not on the price, but on the volatility. It’s a very interesting concept. Why do you share so much about your strategy?

I share it because it's what I use and it's helped me navigate the markets. It's not the holy grail and it won't make you rich, but it will keep a lot of traders out of bad trades and help them understand changing market environments.

In my experience, most traders can come up with good strategies, but they're poor executors because they rely solely on their short-term strategy. They don't understand market environments, and my daily Bollinger band/Fibonacci strategy is to help understand market environments.

When I first developed my day trading strategy, it worked great for weeks, then it stopped working on a dime. I felt I was perfect with my execution, but for some reason, I couldn't wrap my head around the fact that it would work so well then so poorly so quickly. I continued to study what I was doing, and eventually, I started to realize that the market environment had changed.

Even though I was scalping on the super short charts, I needed to see what the daily chart was telling me. This helped me with position sizing. This is when I came up with Big, Small, or not at all. I wrote that on a card to confirm that when the market environment was conducive to my strategy, trade big. When it wasn't, trade small or not at all.

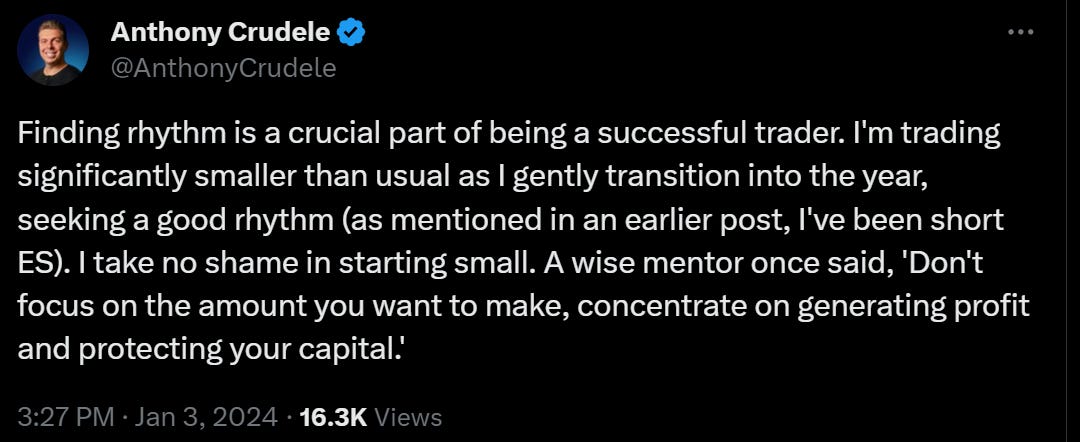

Q) The number one reason I follow you is for your experience combined with brutal honesty. You say that you don’t have it all figured out, that sometimes you need to slow down because you know yourself. I guess this comes after countless rough times in the past. I love the recent tweet below from yours.

Can you share with us what was the Aha moment when you realized that you needed to listen to yourself to make it in this industry?

I believe we all know when we're in a good place mentally and physically. This is when we're trading at our best. When we have underlying issues in our lives, they surface when we're trading. The moment something doesn't go our way in the markets, boom, our frustration fires up. If we're balanced, then we can let it bounce off us. If we're not, it will affect our trading execution.

Rhythm comes from understanding oneself, going with the ebbs and flows, and understanding how to manage ourselves in changing conditions that our mind and body go through, along with changing market conditions. When we're in rhythm, we don't fight change, we roll with it.

Q) Speaking of rough times and brutal honesty, you shared your story of your heart attack at your trading desk almost ten years ago. Trading is stressful, and I found myself very anxious and stressed last year, even though I had a relatively good year. Barely no one talks about mental health on Twitter. Do you have any advice for traders out there on how to manage stress over decades of trading?

Work hard, play easy. If you are working hard at trading, you need to learn how to remove yourself from it when you're not trading. My anxiety and stress all came to me because I let it eat me away inside. Our competitive nature as traders is our best ally, but our worst enemy. It helps us find our edge and fight through adversity, but it eats away at our nervous system if we don’t learn to heal in our downtime. Find something you love to do that forces you to focus on it while you're doing it. For me, it was several things: meditation, running, walking, yoga, pilates, and of course, golf 😊

Q) What does a typical day of grind look like for Anthony Crudele?

My days aren't a grind anymore because I balance my time. First, I make sure I get 7-8 hours of sleep per night at a minimum. Without sleep, I'm not the same person. I need that recovery.

In the morning, I read first, then I make myself a double espresso or cappuccino. After that, I write my note/preparation for the markets.

Following that, I take a walk with my dogs without my phone. I then watch the market open and decide whether to make a trade or not. I do not day trade every day anymore. I am very selective about the days I spend at the screens. Mostly, I manage one of my long-term accounts and focus on swing positions in futures and stocks.

After that, I head to the gym for weights, cardio, pilates, or golf. One day a week is for a massage, and one day is completely off.

I take all of my business calls in the afternoons, and on Mondays, I dedicate my time to recording a podcast. Thursdays are my content days, where I work on Develop Your Edge and record any other videos. I keep my schedule very organized to avoid burning out.

Q) Here’s my favorite tweet from you.

This is very specific, and my readers always ask me how I find all my strategy ideas. How do you come up with ideas like this?

Watching and learning. I feel that even though I'm not trading every day, I am learning something. If you go into the market with an open mind and understand that we really don't know what the market will do, sometimes things come up that hit you right in the face that you've seen time and time again. Maybe you can take advantage of it next time you see it.

Q) You often talk about your mentors on Twitter. Can you share who was your last mentor and what is the biggest takeaway you got from him?

Many of my mentors are not even people I know personally. Sometimes I observe how individuals conduct themselves from afar, and that is something I aim to emulate in my life.

My most recent mentor has nothing to do with trading, but he is a very successful friend of mine. He is a CEO of a company, and I have been discussing with him about building wealth, not just making money. I have been someone who has been pretty good at making money, but not so good at keeping it and building on it.

I've been so market-focused over the years that market fluctuations start to wear me out. I needed some guidance on diversifying myself for the future so I'm not solely reliant on my market performance to grow my capital. I believe all traders need to consider this too.

Most of us have a plan on how to become successful traders, but few of us have a plan on what to do once we have achieved some success. Sustaining success and building on your wealth are challenging for many of us because we did not have money to begin with. When you finally earn some money in this business, you need to have a plan to retain it and grow it outside of markets.

Q) Do you remember your worst and best trading day ever? What did it look like?

I had several days that were similar in terms of being my best days, but the day that stands out the most to me in my career was the first time I made over $100,000 in a day. This day is particularly memorable for a couple of reasons.

The first, and most obvious, reason was that it was my first six-figure day. Secondly, it was just a normal day in the markets. It was in the early 2000s, and the trading range was only 15 points in the ES. Back then, that was a pretty normal day. I had been on a decent run, so my mental state of mind was very balanced, and my confidence was high.

I was making all the right decisions in my trading. I was in complete control of my decision-making. I just got on an early morning rhythm that carried out throughout the midday. Rotations to my strategy levels were pretty clean, and I was taking on bigger size because I had been winning lately, and the market was giving me great feedback that my strategy was working extremely well. I took advantage of the market on a nothing day, and it changed the way I looked at things.

First, it made me believe that I could be a million-dollar-per-year trader. I could handle the swings and size it would take. It was a good test of my capabilities. I knew from that moment how important it was for me to be in a good state of mind, have great self-awareness, and confidence in what I was doing.

The ironic part about all of that is that my worst day ever was after that day. I made just over $100,000, and the next day I lost $100,000. A complete breakdown. I learned another important lesson. I didn't have a plan for when I made that kind of money; therefore, I blew it the next day. I was numb to the fact that I had just made more than I had made in most of the months in my career.

I didn't know how to react beyond that moment, therefore I self-destructed the next day. Many traders will experience their best day and their worst day in consecutive days. It's the lack of planning for when you have a great day and its overconfidence. It's also the fact that you now think you 'can afford' to risk more.

So many lessons came from those two days; there's not enough time to go over it in this blog. I will say that following that screw up, the next time I made six figures in a day, I took the following week off.

Q) Finally, do you have one piece of advice for the readers who are struggling in their trading journey?

My advice these days to traders is to give yourself the gift of time. I was so shortsighted early on in my career, and it took me years to become a trader, then years to make money as one. In today's fast-paced world, traders have set their expectations too high, and they can become traders in just a few short minutes after opening an account.

This business is a long-term investment, and there are no short-term gains. This business can give you everything you desire if you put your ego aside, give yourself time, and can deal with losses.

If you are in this for the short-term buck or thrills of the market, the market will not only take from you financially, but it will also take from your health. Take your time, slow things down.

Q) Anthony, where can our readers find you if they want to learn more from you?

www.AnthonyCrudele.com for my podcast, daily notes, and technical videos…they are all free. My main social media is on X @AnthonyCrudele

</THE END>

This was my favorite interview from Retail Capital so far. Anthony is so humble and has such genuine advice, and it's a breath of fresh air to see someone who has his experience be so sharing and down to earth with other traders. You can tell he really wants to help people. Great Job RC

This was absolutely great guys. Thanks so much for this amazing share. 💯❤️